Hi members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

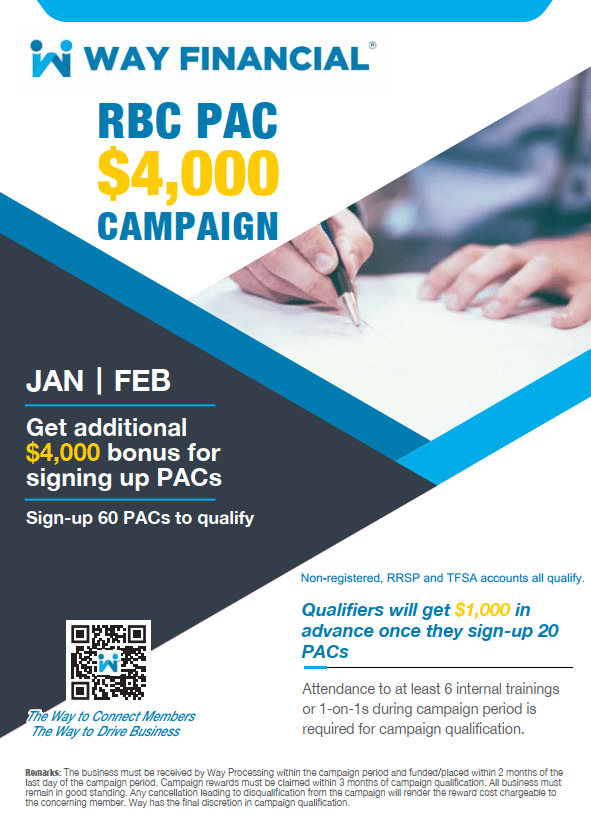

March & April Campaigns starting tomorrow – $54,000 up for grabs!

Asset Creation Plan (ACP) and Connection Advanced Bonus Campaigns with the maximum reward of $54,000 will start tomorrow! Attend at least 6 internal trainings or case studies during campaign period as part of the prerequisites to winning.

Feel free to ask Stephen Lai if you have any question on the business submissions at stephen.lai@www.wayfinancial.ca or 604-279-0866 ext. 114. Members’ Relations Manager, Samuel Xu, is also available to help you with your connections. Reach out to him at relations@www.wayfinancial.ca or 604-279-0866 ext. 120.

Upcoming Client Events

Summary of RRSP Tax Efficient Withdrawal Solutions & 3 Reasons to Decide Not to Buy RRSP

Date: Saturday, March 5, 2022

Language: Mandarin

Time: 10:55 am PST

YouTube link: https://youtu.be/ClcJsTA8NG4

Language: Cantonese

Time: 1:55 pm PST

YouTube link: https://youtu.be/yYgHzdALLGs

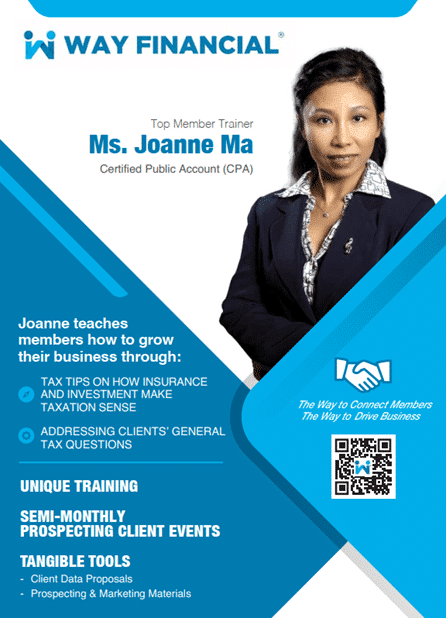

Check out the posters below for broadcasting to your clients.

Please note that topic “3 Reasons to Decide Not to Buy RRSP” is only available for the Cantonese session.

And here is the registration link: http://sv.mikecrm.com/WM6hnGM

Ask admin@www.wayfinancial.ca if you have any question.

New Members Boot Camp – helps you double your income and/or achieve MDRT!

The next series of New Members Boot Camp will start next week on March 7, 2022. New members will receive an invitation to attend the whole camp, while experienced members are welcome to join individual classes through registering with Administration (admin@www.wayfinancial.ca) based on their needs. Live sessions will be hosted for attendance of 10 members or more. Otherwise, a hybrid set-up with live and playback elements will be arranged. See the curriculum attached and schedule below.

| Date | Time | Topic | Audience |

| Mar 7 | 10am – 1pm | Class 1: Basic insurance product suitability for various types of clients | Green members |

| Mar 8 | 10am – 1pm | Class 2: Various financial carriers’ strengths by software/illustrations comparison | Green members |

| Mar 10 | 10am – 1pm | Class 3: Investment – Untapped market especially amongst Asian clientele | Green members |

| Mar 14 | 10am – 1pm | Class 4: Business cycle – marketing, prospecting, advising, servicing, referring, repeating

(with Special Guest Trainer) |

Green & Experienced members |

| Mar 15 | 10am – 1pm | Class 5: Way’s uniqueness – helping various types of members achieve their goals | Green & Experienced members |

| Mar 17 | 10am – 1pm | Class 6: Applying Way’s Tools

(with Special Guest Trainer) |

Green & Experienced members |

| Mar 21 | 10am – 1pm | Class 7: Compliance to help your ship sail smoothly in the ocean | Green & Experienced members |

| Mar 22 | 10am – 1pm | Class 8: Unique financial concepts and calculation tools

(with Special Guest Trainer) |

Experienced members |

Upcoming Trainings (Internal training sessions qualify for campaign)

Please remember to sign in using your full name to have your Way Membership confirmed and your training session uninterrupted. Unconfirmed names may be removed from the session.

Also note that the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

Time & Date: 11:00am PST, Wednesday, March 2

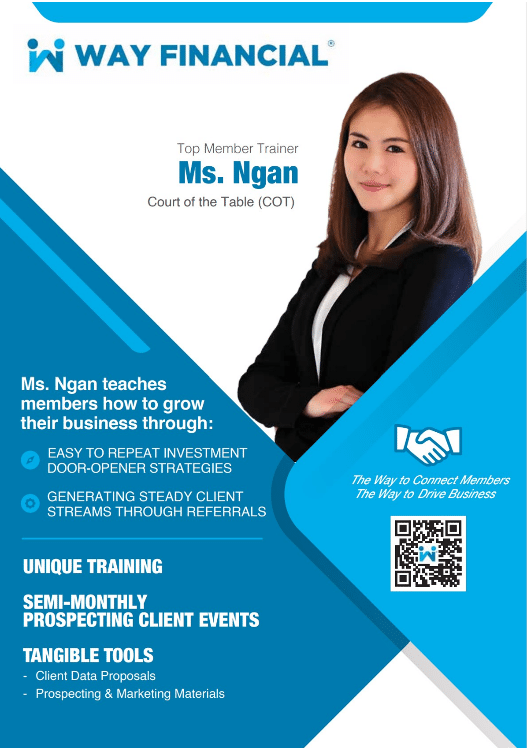

Investment Planning / Strategy: Transfer-In / Investment amount: Total $1 million – COT Amanda Ngan

Our top member, COT Amanda Ngan will teach you how to transfer client’s investment accounts from bank and apply meltdown strategy afterward which may involve a total of $1 million investment business.

Click here to join the meeting

Time & Date: 11:00am PST, Friday, February 25

Path To Success About Critical Illness Part I – EQ Monica

Click here to join the meeting

Upcoming Case Studies (30 mins or 1 hour sessions available) – all sessions count towards campaign qualification

Bring a case to get your desired results. All you need to bring is the client’s name and enquiry area. Examples include:

- How to present the case (illustrations & presentations help)

- How to respond to clients’ objections

- How to get repeated or referral business

- How to start the conversation

Check out the case studies schedule in March below and book your session online via the Way Platform Events Calendar or contact admin@www.wayfinancial.ca or 604-279-0866 for assistance.

|

Time & Date: 2:00 – 6:00pm PST, Friday, March 2 Case Studies with COT Amanda Ngan Time & Date: 1:30 – 4:30pm PST, Friday, March 4 Case Studies with EQ Monica Zhang Schedule of Case Studies in March 2022 |

| Monday | Tuesday | Wednesday | Thursday | Friday |

| 31 | 01 | 02 | 03 | 04 |

| Case studies with COT Amanda Ngan (2:00-6:00pm) | Case studies with EQ Monica Zhang (1:30-4:30pm) | |||

| 07 | 08 | 09 | 10 | 11 |

| Case studies with COT Sophia Li (12:30-1:30pm)

Case studies with SL Renee Ho (1:00-3:00pm) |

Case studies with CL Insurance Carol Ng (1:00-3:00pm) | |||

| 14 | 15 | 16 | 17 | 18 |

| Case studies with ML Chris Chang (1:00-3:00pm) | ||||

| 21 | 22 | 23 | 24 | 25 |

| Case studies with RBC Mike Jackson (1:00-3:00pm) | Case studies with CL Insurance Richard Chen (1:00-3:00pm) | |||

| 28 | 29 | 30 | 31 | 30 |

Carriers’ Updates

Canada Life

Insurance

New rates and enhancements for Canada Life’s term products

Your illustration software will be updated with the new rates on March 7. Click here to read more

| Canada Life My Term promo pricing ending soon |

| Last chance for your clients to save on one of the most flexible term products on the market. Clients could save 10% or 15% on qualifying new Canada Life My Term policies for applications received by March 6. Click here for the details |

Contact Carol Ng at 604-377-7203 or Carol.Ng@CanadaLife.com or Amber Wang at 226-272-1297 or AmberHanYi.Wang@canadalife.com or Wenjia Li at 6046125105 or wenjia.li@canadalife.com if you have any questions.

Equitable Life

Insurance

Webinar Topic: Building A Stronger Investment Portfolio with Equimax Participating Whole life (1.00 Life CE)

Time & Date: 9 am PST, Tuesday, March 1.

Register in advance for this webinar:

https://equitable-ca.zoom.us/webinar/register/WN_gUoFNRqFQw-trXJuopF4ng

Contact Monica Zhang at 604-366-4314 or mzhang@equitable.ca if you have any question.

Manulife

Investment

Webinar Topic: Market Update: Conflict in Ukraine – Implications for Investors, featuring Macan Nia

Description: Due to the mounting tensions between Russia and Ukraine, oil prices reflect this concern as it has increased more than 40% since the beginning of December on concerns of a disruption in Russian energy supplies. Speaker Macan Nia, CFA will discuss the environment and what it means for investors, central bank policy moving forward and commodity prices.

Time & Date: 10 am PST, Tuesday, March 1

Register in advance for this webinar:

https://manulife-johnhancock.zoom.us/webinar/register/WN_2Nk_g6YETvCTazdqMlA5ZQ

News from Insurance Council of British Columbia

Updated Council Rules Course will be launched on March 15, 2022

This course is a prerequisite for all new insurance licence applicants and can also be taken by licensees to count towards their continuing education requirements.

Click here for more details.

Annual licence renewal and fee changes

Licence renewal opens on April 1, which will include changes to fees that will come into effect for the upcoming licence year that starts on June 1.

Click here to see the fee changes.

Best Regards,

Administration Department

“The WAY to connect members. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

Greater Vancouver Area (GVA)

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

Greater Toronto Area (GTA)

Suite N500, 675 Cochrane Drive

North Tower, Markham, ON L3R 0B8

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.

279-0866 ext. 114.

279-0866 ext. 114.

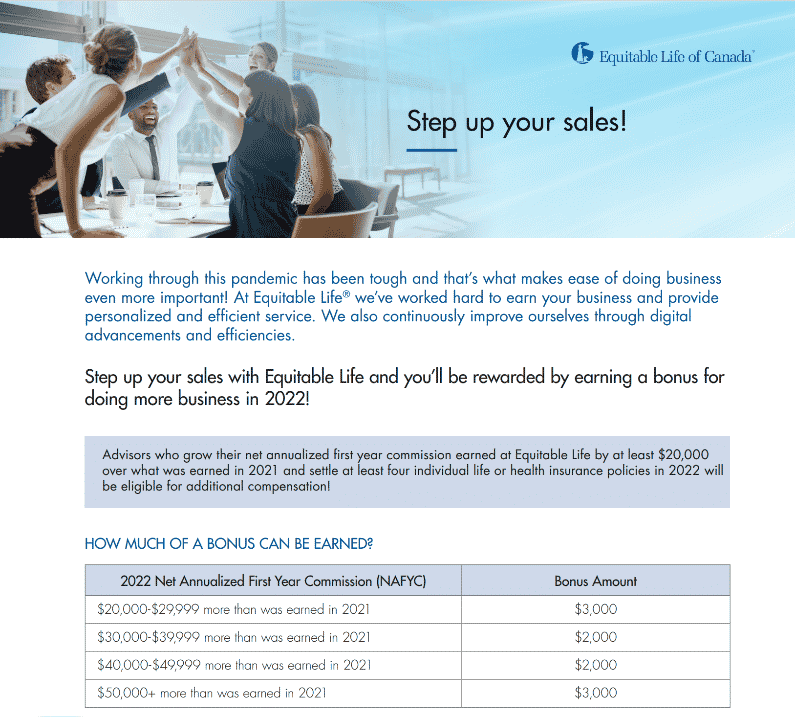

Read attached PDF file (EQ Step Up Your Sales 2022) for more details.

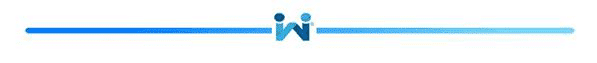

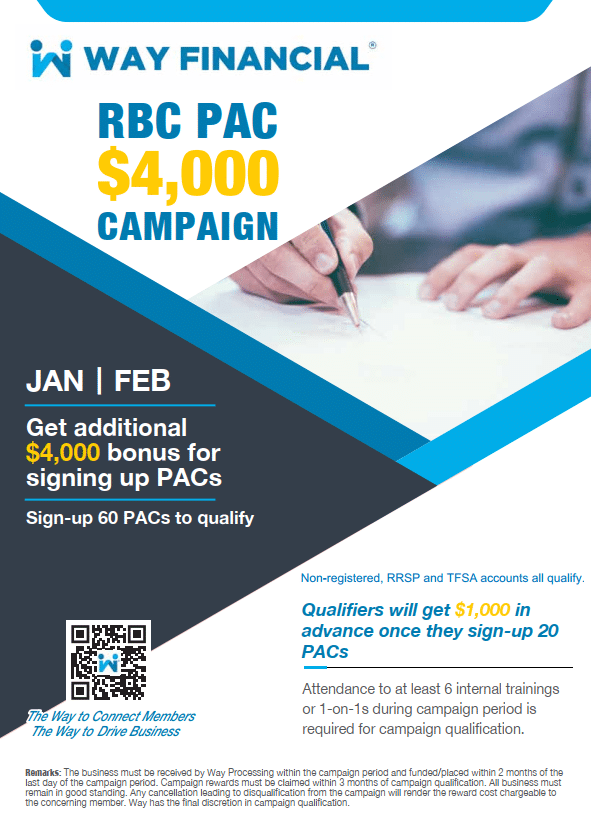

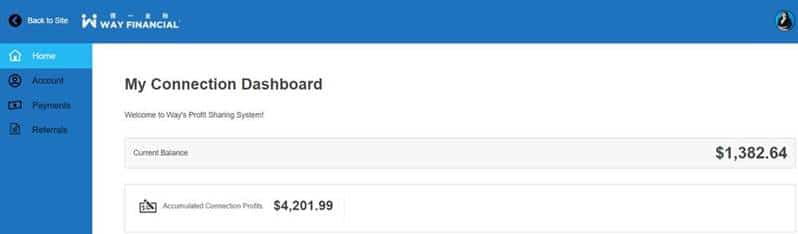

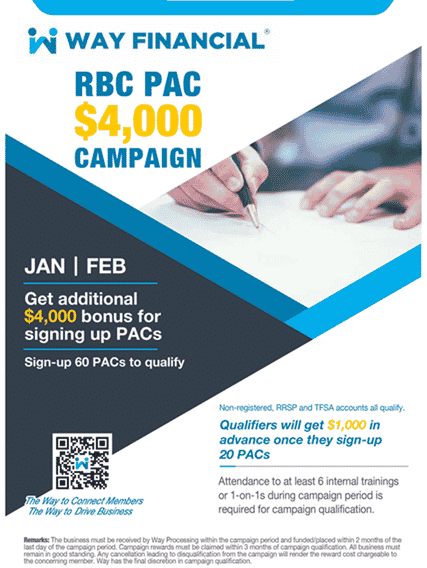

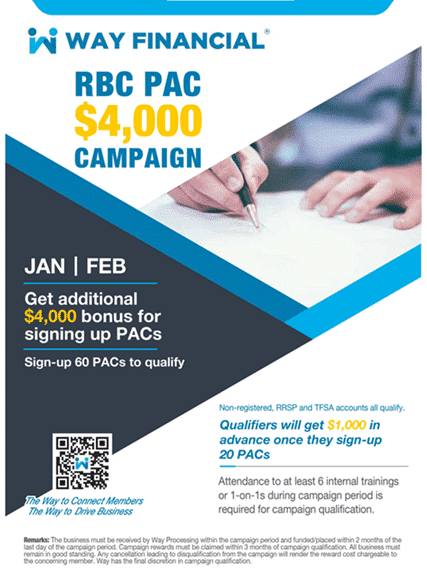

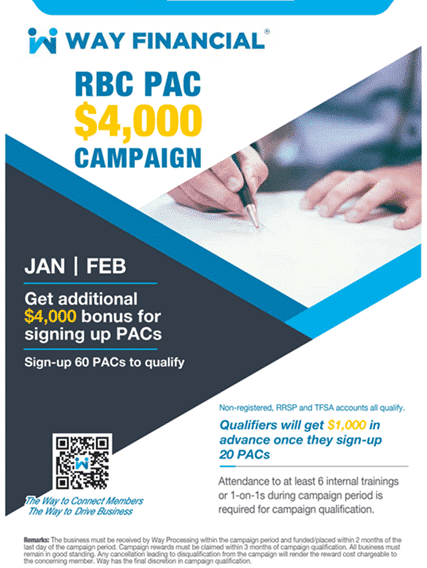

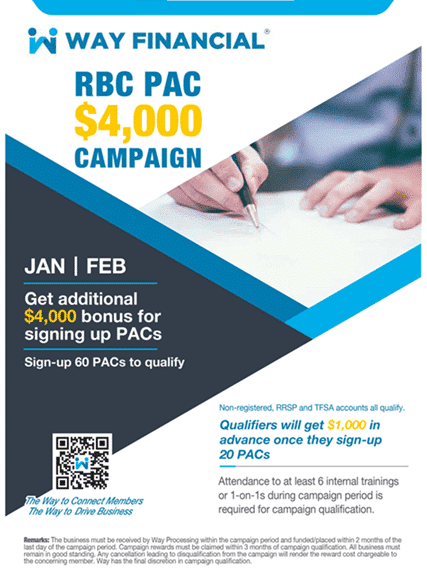

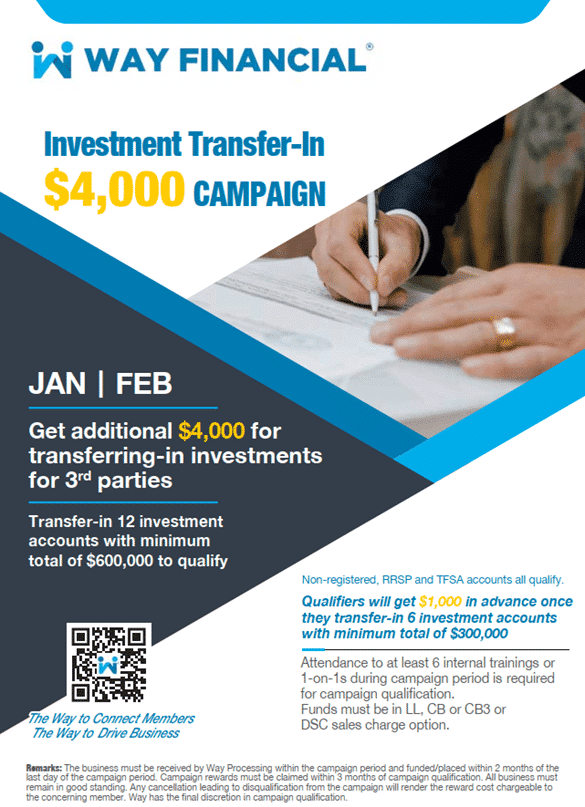

Read attached PDF file (EQ Step Up Your Sales 2022) for more details. Two weeks left for the Investment Transfer-In and RBC PAC Campaigns! Make sure you attend at least 6 internal trainings or 1-on-1s to not only learn the business strategies but also to qualify for each campaign. Feel free to ask Stephen Lai if you have any question on the business submissions at

Two weeks left for the Investment Transfer-In and RBC PAC Campaigns! Make sure you attend at least 6 internal trainings or 1-on-1s to not only learn the business strategies but also to qualify for each campaign. Feel free to ask Stephen Lai if you have any question on the business submissions at

The Investment Transfer-In and RBC PAC Campaigns are on! Make sure you attend at least 6 internal trainings or 1-on-1s to not only learn the business strategies but also to qualify for each campaign. Feel free to ask Stephen Lai if you have any question on the business submissions at

The Investment Transfer-In and RBC PAC Campaigns are on! Make sure you attend at least 6 internal trainings or 1-on-1s to not only learn the business strategies but also to qualify for each campaign. Feel free to ask Stephen Lai if you have any question on the business submissions at

Make sure you attend at least 6 internal trainings or 1-on-1s to not only learn the business strategies but also to qualify for the campaign. Feel free to ask Stephen Lai if you have any question on the business submissions at

Make sure you attend at least 6 internal trainings or 1-on-1s to not only learn the business strategies but also to qualify for the campaign. Feel free to ask Stephen Lai if you have any question on the business submissions at